Compare the Best Medicare Supplemental Plans 2021 for Healthcare

Medical researches have fund out the insurmountable demand for old-age patients to pick decent healthcare insurances so they can cover their out-pocket expenses. At precisely the exact same circumstance, private insurance companies have designed surpassing healthcare plans that maintain its benefits intact, even for your Medicare supplemental strategies 2021. There's always a better option on the market to save money by reducing the monthly premiums in order that regular clinic costs and prescription bills could be discharged by simplicity.

Comparing Medical Supplemental Plans

First things first, a health supplemental strategy is appropriate for fulfilling the gaps which are ordinarily left out by the decisive part B and A of this original Medicare plan. Therefore, premium costs irrespective of age and location are mandatory. It is these companies that market both high-end and low-end insurance programs, according to their collection prices so that people do not have to worry about the coverage needs over time

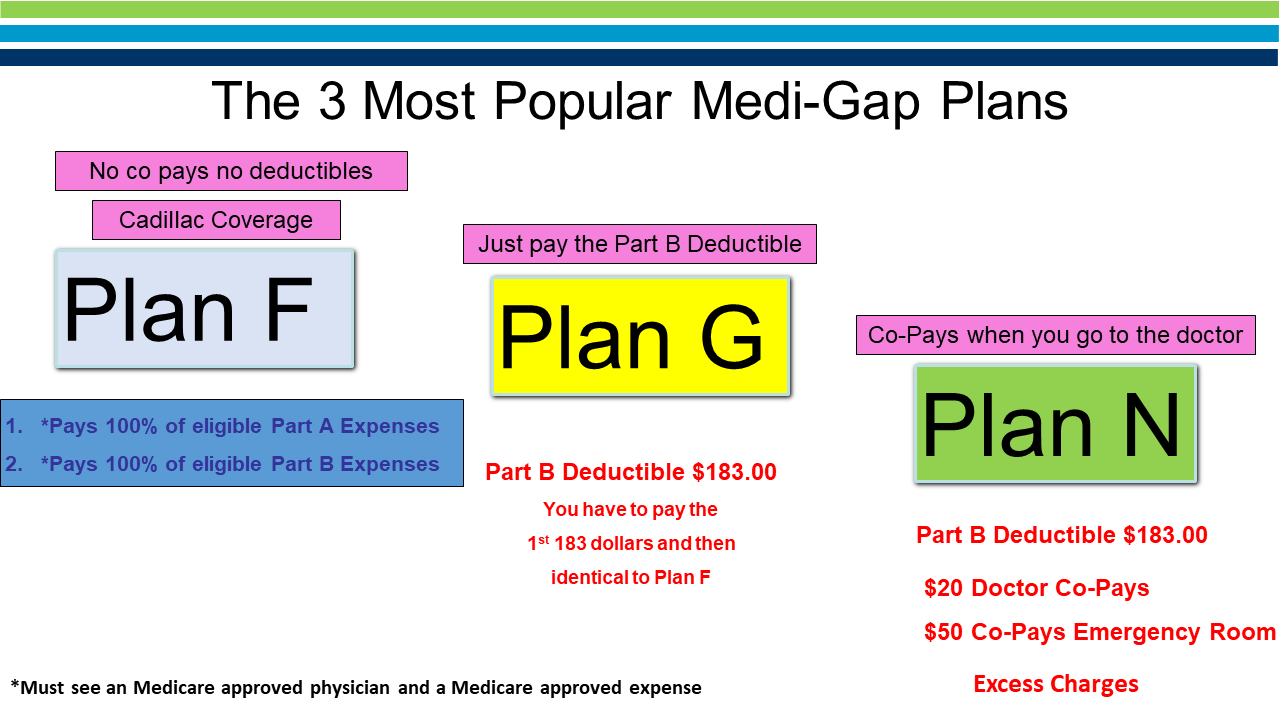

To jot down on the Medicare supplement plans comparison chart 2021, one has to first understand these supplemental plans range from letter A to N, wherein the first two letters cover the simplest extracts of basic benefits. Without experiencing such changes, it must be noted-

• Part A Medicare consists of coinsurance advantages and other additional costs to hospital care.

• Part B is composed of coinsurance deductibles or copayments concerning blood cost or other kinds of problems such as hearing vision, or dental remedy.

The likes of Medicare supplement plans 2021 AARP comes from the insurance company of AARP in close operation with Medicare that makes sure to present good premium rates despite the age group of 65 or some specific site. Plan F is strictly preventive of taking action because other components are rather instrumental in handling emergency expenses or foreign travel cost concerning coinsurance and deductibles.

Bottom Line

It has to be understood that individuals ought to be aware of the enrolment tenure for your Medicare plan so they can select a proper insurance provider and follows its regulated conditions so that medical costs can be cut down that are generally leftovers of the Original Medicare.

Comments

Post a Comment